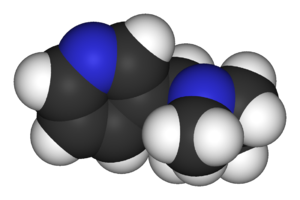

Image via Wikipedia

Image via Wikipedia By Val Brickates Kennedy,

MarketWatch

BOSTON (MarketWatch) -- Shares of biotech group Xoma Ltd. spiked over 1,000% at market open Wednesday as the company conducted a 1-for-15 reverse stock split in order to boost its stock price to meet

Nasdaq compliance rules.

For the next 20 trading sessions, Xoma will trade under the stock symbol XOMAD to reflect the split; after that time, the stock will revert back to its previous trading symbol of XOMA.

Xoma also announced that it has sold its royalty rights to the antibody treatment

Cimzia for $4 million to an undisclosed buyer. The product, which is approved in the U.S. for the treatment of

Crohn's disease and rheumatoid arthritis, is marketed by UCB S.A.

Shares of Xoma(XOMAD 3.68, -0.54, -12.82%), trading under its new symbol, were down 11% at $3.77.

Jazz Pharmaceuticals shares (JAZZ 11.37, +1.12, +10.93%) rallied after documents released by the U.S. Food and Drug Administration revealed that agency reviewers believe its drug candidate JZP-6 is effective in treating the pain condition fibromyalgia. The documents, however, also showed that they still have certain safety concerns about the medication.

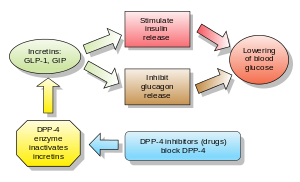

Image via Wikipedia Fritz French, Chief Executive Officer, Marcadia Biotech, Carmel, Ind.

Image via Wikipedia Fritz French, Chief Executive Officer, Marcadia Biotech, Carmel, Ind.