Image via CrunchBase

Image via CrunchBase Here is Ocotber's FDA Calendar. Along with the Calendar I have put my recommendation for each stock. Some you should really be buying, like Alkermes, others you should be shorting, like Arena, Vivus, and Jazz Pharma.

The poll has 3 results:

1. Full Approval

2. Complete Response Letter (aka delayed approval or no approval)

3. No Decision (more time, the FDA has a lot of approvals in such a given short period)

Oct. 1:

Hospira's(HSP) Dyloject for acute moderate to severe pain in adults. (CRL)---Big Company so no big deal, still a buy

Oct. 4:

Human Genome Sciences'(HGSI) Zalbin for hepatitis C. (CRL--Lupus drug approval set for December so still a buy)

Oct. 11:

Alexza Pharmaceuticals'(ALXA) AZ-004 for agitation in patients with schizophrenia or bipolar disorder. (I'm going with No Decision, short this stock, as this is their first FDA decision for the Staccato technology) Slightly leaning toward CRL but I will say No Decision as my final answer.

Oct. 11:

Jazz Pharmaceuticals'(JAZZ) JZP-6 for fibromyalgia. (CRL--FDA panel killed this drug, it works but the FDA isn't approving a GHB type drug right now. Short this stock)

Oct. 12:

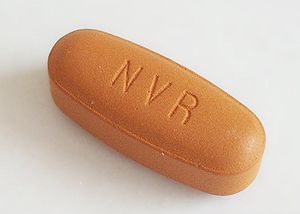

Alkermes'(ALKS) Vivitrol for opioid addiction. (Full Approval--Jim Cramer would say Buy, Buy Buy)

Oct. 16:

ISTA Pharmaceutical (ISTA) XiDay is simply aonce daily version of twice daily solution, and avoid generic competition (FDA Approval)

Oct 22:

Arena Pharmaceuticals'(ARNA) lorcaserin for obesity. (No way in he##, CRL) I would recommend shorting this stock.

Oct 22:

Amylin Pharmaceuticals(AMLN) (Partnered with Alkermes and Eli Lilly) Once weekly Diabetes Shot exenatide or Bydureon---This is a delay from CRL in March so I expect Full Approval this time around.

Oct 28:

Vivus'(VVUS) Qnexa for obesity. (Give me a break, CRL) I don't care what data they have come up with, I would recommend Shorting this stock.

Oct 29:

Avanir Pharmaceuticals'(AVNR) Zenvia for pseudobulbar affect. (I'm going to go with Full Approval although it's a toss-up)

Forest Labs(FRX) ceftaroline for Community Acquired Pneumonia. I can't find this on the FDA calendar---But I will say Full Approval even though I can't find it.

Oct 30:

Biodel's(BIOD) Linjeta for diabetes. (No Decision, short this stock) Again on the fence, possible CRL.

Image via WikipediaNEW YORK (TheStreet) -- Not all investors are shocked and upset about the decision by U.S. regulators to reject Amylin Pharmaceuticals' (AMLN) diabetes drug Bydureon. Short-sellers -- investors who bet that Amylin shares would fall -- are positively giddy and making money.

Image via WikipediaNEW YORK (TheStreet) -- Not all investors are shocked and upset about the decision by U.S. regulators to reject Amylin Pharmaceuticals' (AMLN) diabetes drug Bydureon. Short-sellers -- investors who bet that Amylin shares would fall -- are positively giddy and making money.