Today's Market News Video

Recent PR Newswires for Biotech and Pharmaceuticals today.

Companies Mentioned, Powered By Wikinvest.com

Cepheid (CPHD)Novartis--(NVS)

Cumberland Pharmaceuticals (CPIX)

Hospira (HSP)

Abbott Laboratories (ABT)

Sucampo (SCMP)

Hospira Announces New Contracts in Effect with Novation for Infusion Pumps, Solutions and Equipment

Stock investments ranging from Biotech, Pharmaceutical, and Medical Devices in the Healthcare Sector. Covering Clinical Trial recommendations and FDA Approvals.

Showing posts with label Novartis. Show all posts

Showing posts with label Novartis. Show all posts

10/7/10

Novartis inks Vaccine Deal, Hospira Signs New Contracts, Abbott Labs & Japanese Sucampo Announce Positive Phase III results

Labels:

Abbott Laboratories,

Cepheid,

Chronic myelogenous leukemia,

Cumberland Pharmaceuticals,

Flu Shot,

Hopsira,

Influenza,

Novartis,

Sucampo,

Sythetic Genomic,

Vaccine Production

9/23/10

Novartis Gains FDA Approval For Oral MS Drug

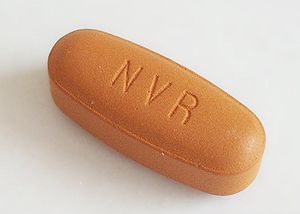

Image via WikipediaNovartis is now a game changer in MS market. Novartis is usually known for their vaccines, is the first in the oral pill MS drug market. Top News from Novartis as MS drug, Gelenya was approved from the FDA Monday.

Image via WikipediaNovartis is now a game changer in MS market. Novartis is usually known for their vaccines, is the first in the oral pill MS drug market. Top News from Novartis as MS drug, Gelenya was approved from the FDA Monday. Wikinvest: Novartis AG (NVS)

Labels:

Biogen,

Biogen Idec,

Genlenya,

MS,

Multiple Sclerosis,

Novartis,

NVS,

TheStreet,

Tysabri,

WikInvest,

WSJ

9/13/10

Ariad and Cyclacel To Start Clinical Trials for Blood Cancer Drugs for Leukemia

Image via Wikipedia From The Street's Adam Feuerstein

Image via Wikipedia From The Street's Adam FeuersteinAriad, Cyclacel To Start Key Drug Trials

Stock quotes in this article:ARIA, CYCC, SGEN, NVS, BMY

Labels:

Acute myeloid leukemia,

ARIA,

Ariad Pharmaceutical,

BMY,

Clinical trial,

CYCC,

Cyclacel,

Food and Drug Administration,

Leukemia,

Novartis,

NVS,

Seattle Genetics,

SGEN

9/6/10

Comprehensive List of Drugs Approved During the Summer 2010

I found this nice list of 2010 drug approvals on The Health Wisdom Blog. This probably is the most informative posting on Drug Approvals from 2010.

I found this nice list of 2010 drug approvals on The Health Wisdom Blog. This probably is the most informative posting on Drug Approvals from 2010.Glaxo (GSK), Merck (MRK), Novartis (NVS), Sanofi-Aventis (SNY), and Amgen (AMGN) were again at the top on these approvals.

New Drugs Approved Summer 2010

New drugs not only offer hope, but possibly a better quality of life, for those awaiting new treatments. However, new drug approvals can also spark controversy. The FDA approved 17 new drugs this summer (June-August 2010). Many offer new promise, and one in particular promises a great deal of future debate.

Labels:

2010 Drug Approvals,

Amgen,

ella,

Glaxo SmithKline,

HRA Pharma,

King Pharmaceuticals,

Merck,

Novartis,

Sanofi-Aventis

9/5/10

Comprehensive List of Drug Approvals From 2009

Image by boodoo via Flickr I found a nice list of all the drugs approved in 2009 and their respectable companies.

Image by boodoo via Flickr I found a nice list of all the drugs approved in 2009 and their respectable companies.Those of note were Glaxo SmithKline (GSK) with HPV vaccine, H1N1, seasonal flu vaccine, renal carcinoma, and lymphocyte leukemia.

Novartis (NVS) for H1N1, seasonal flu vaccine, MS, malaria, and schizophrenia.

Schering-Plough, now Merck (MRK) , for schizophrenia. Schering was bought out for their extensive drug pipeline of numerous upcoming drugs.

Sanofi-Aventis (SNY) had an antiarrhythmic drug, along with another flu vaccine for elderly patients. Sanofi is getting snuffed out with the Genzyme takeover bid but the bidding could still continue.

Others included Takeda Pharmaceuticals (TKPHF), Cypress Biosciences/Forest Labs, Allos Therapeutics, Lilly/Daiichi Sankyo, Gloucester Pharmaceuticals, and Theravance.

Labels:

Allos Therapeutics,

Cypress Biosciences,

Daiichi Sankyo,

Eli Lilly,

Forest Laboratories,

GlaxoSmithKline,

Merck,

Novartis,

NVS,

Sanofi-Aventis,

Schering-Plough,

Takeda Pharmaceutical,

Theravance

8/31/10

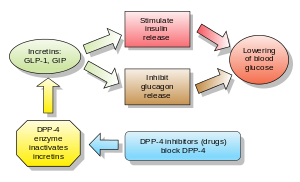

New Targets, Dual Agonists Increase Possibilities for Treating Diabetes

Image via Wikipedia Fritz French, Chief Executive Officer, Marcadia Biotech, Carmel, Ind.

Image via Wikipedia Fritz French, Chief Executive Officer, Marcadia Biotech, Carmel, Ind.Drug Discovery & Development - August 16, 2010

Diabetes is a common chronic disease affecting an estimated 285 million adults worldwide. This number will continue to grow as the population ages and becomes more obese—both risk factors for type 2 diabetes. The diabetes treatment market generated over $25 billion in 2009 and the number of patients is continuously rising.

Labels:

Amylin,

AstraZeneca,

Bristol-Myers,

Eli Lilly,

Galvus,

GSK,

Incretin Pathway,

Insulin,

Januvia,

Marcadia Biotech,

Merck,

Novartis,

Novo Nordisk,

Onglyza,

Roche,

Type 2 Diabetes,

Victoza

8/25/10

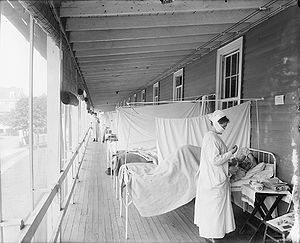

Chasing Influenza: History of the Flu

Image via Wikipedia Here is a really informative article on the History of the Flu by Quintiles White Papers. PDF format is the link below. It's Flu season again. Companies are ramping up their stockpiles of Flu Vaccines and you can get the flu shot at Walgreens and CVS these days.

Image via Wikipedia Here is a really informative article on the History of the Flu by Quintiles White Papers. PDF format is the link below. It's Flu season again. Companies are ramping up their stockpiles of Flu Vaccines and you can get the flu shot at Walgreens and CVS these days. I personally don't believe all the hype and practice safe "People handling" when I go out and use hand sanitizers every chance I get. One day a real Pandemic will emerge like the 1918 Flu and there is not much we can do about it. Novartis, Glaxo SmithKline, Baxter, and MedImmune are your top Flu stocks.

Chasing Influenza

Labels:

Baxter,

DynPort,

DynPort Vaccine,

Flu season,

GlaxoSmithKline,

GSK,

Influenza,

MedImmune,

Novartis,

Quintiles White Papers,

Solvay Pharmaceuticals,

SVA

9/27/09

Swine Flu Remains Mild as Vaccine Advances

Last week Swine flu stocks slumped so it remains to be seen if they will rise again against a Mild Flu season. The small cap swine flu stocks are very volatile right now. Big players remain strong. Anticipate 3rd and 4th quarterly earnings for GlaxoSmithKline and Novartis to rise. Cel-Sci Corporation's new vaccine production could remain a pivotal turn for the only small cap not to have lost huge returns last week. I am curious to see how this Week on Wall Street pays off. Stocks to watch are Sinovac (SVA), Novavax (NVAX), Novartis (NVS), Glaxo (GSK), and Cel-Sci (CVM).

Labels:

GlaxoSmithKline,

Infectious disease,

Influenza,

Novartis,

Sanofi-Aventis,

Swine Flu Outbreak,

Swine Flu Stocks,

Swine influenza

8/23/09

Novartis recieves $690 million order for H1N1

Swiss company Novartis (NYSE: NVS) received an order for $346 million for antigen and $343.8 million for adjuvant totalling $690 million in July. Currently, Novartis is building a vaccine facility in Holly Springs and is hiring right now for validating the buildings and getting them up and running. So there are plenty of jobs created from their vaccine business and profits to come. Validation of buildings and facilities can be a pain-staking process but I expect them up and running by late 2009 Q4, if not sooner.

Current trading for Novartis is up around the 44-46 range. This is from their low point earlier this year with the global economic downturn, where their stock was trading around their 52 week low of 33.34. Their 52 week high is 56.23. It achieved this level twice in August 2008 and November 2006. So they are about midway to their highpoint and that is good news. I really don't see why a year from now they wouldn't be trading in the 60 point range again if not sooner. They have a healthy order of 690 million from the US government and are the striving to be the top vaccine maker in their sector.

What I like most about Novartis is that they have 337 open studies actively recruiting patients according to ClinicalTrials.gov. This is where their future lies. According to their website Novartis.com they have 155 projects in various stages of clinical trial. Here is a link to their 2009 and >2012 Novartis Pipeline. Most importantly, there are over 40 biologic molecules in the Novartis pipeline, and Novartis Biologics is growing. Roughly, 25% of their pipeline is in biologics. This is healthy for profits and for Novartis' future.

August 17, 2009 found FDA approval for the drug Extavia® (interferon beta-1b), the first in a new planned portfolio of multiple sclerosis (MS) medicines from Novartis to help patients manage this devastating disease. Extavia will be available to patients in the US this fall. The European Union has already approved Extavia in 12 countries.

Looking over their financials they are in good shape for the future. Most importantly, they own Sandoz, their $7.6 billion in 2008 sales Generic drug manufacturer. This is key for the future as many drugs are expiring and entering the generics market. They have a current market cap of 103Billion and 2Q 2009 profits of 2.044 billion and earnings of 0.90 per share. This wasn't as high as expected due to the fall in the dollar. Read more about the second quarter prospectus here: Novartis Q2 2009 Report. Although the global economic crisis was going on Novartis increased sales in various sectors. Most impressive sales included the oncology market and Diovan, a high blood pressure medication. Full sales data for Novartis can be found here for 2008: Novartis Product Sales

Gleevec/Glivec (USD 1.9 billion, +15% lc), a targeted therapy for certain forms of chronic myeloid leukemia(CML) and gastrointestinal stromal tumors (GIST), has achieved sustained double-digit growth based on its leadership position in treating these cancers backed by new clinical data and regulatory approvals. Glivec received European regulatory approval in May 2009 as a post-surgery (adjuvant setting) therapy for GIST following Swiss (February 2009) and US (December 2008) approvals.

So I really like the future and growth of Novartis. At their mid range of 45.49, I see it as a buy with long-term potential and plenty of room to grow for the future.

8/19/09

Top 10 Drug Sales Charts and Forecasts 2014 & Generic Drug Superstars

Recently a top 10 drug list was forecast for the year 2014. 5 years down the road. So lets take a look at them. The list was provided by Evaluate Pharma and its a great tool for forecasting stock futures. The list is not perfect. The ones at the top tend to stay there for a reason. Nonetheless, I like the forecast. It's heavy on the Biotech sector and most on the 2014 forecast list are Cancer Therapeutics. Biotech is set to go from 28% of sales today to close to 50% in 2014. Seven of the top 10 drugs in 2014 are forecast to be biotech in origin. This is especially important with pharmaceuticals as biologics are hard to make into generics.

Patent law changes could occur and drug makers are forced to come up with new ways to generate profit. So it's really important to forecast when patents expire and also include generic makers into this list. Teva, Watson(WPI), Mylan(MYL), , K-V, Hi-Tech(HITK), Caraco(CPD), and Sandoz are some of the major generic makers today. Projected sales for the year 2012 are around $30 Billion. My only problem with generic makers, recently has been their quality contol issues. Both Mylan and Caraco have had major setbacks with the FDA this year. If they can control this they should be fine. Often quality control issues and deviations can really hurt companies and must be addressed quickly and ethically.

Major hits to big pharma include the following.

1. Fentanyl--Mylan

Launched: January 2005

2008 sales: $900 million

Branded equivalent: Duragesic, by Janssen (JNJ), 2008 sales of $1.1 billion

2. Amlodipine besylate and benazepril hydrochloride---Teva

Launched: July 2007

2008 sales: $779 million

Branded equivalent: Norvasc, by Pfizer (PFE, Fortune 500), 2008 sales of $2.2 billion

3. Metoprolol succinate---K-V

Launched: May 2008

2008 sales: $675 million

Branded equivalent: Toprol, by AstraZeneca (AZN), 2008 sales $807 million

4. Lamotrigine---Teva

Launched: February 2005

2008 sales: $671 million

Branded equivalent: Lamictal, by GlaxoSmithKline (GSK), 2008 sales $1.6 billion

6. Omeprazole---Watson

Launched: July 2008

2008 sales: $609.8 million

Branded equivalent: Prilosec, by AstraZeneca, 2008 sales $1.1 billion

7. Azithromycin---Teva, & Sandoz

Launched: November 2005

2008 sales: $599 million

Branded equivalent: Zithromax, by Pfizer, 2008 sales $429 million

8. Budeprion---Anchen, IMPAX Laboratories, & Teva (Joint Effort although new lawsuit pending)

Launched: December 2006

2008 sales: $521 million

Branded equivalent: Wellbutrin, by Biovail (BVF), 2008 sales $579 million

With that said of generics, Big Pharma will find ways to address and consolidate their earnings, including buying up generic makers. The next wave of mergers could be in the generic industry. We will have to see. But biologics are where the future lies. Biologics are tough to reproduce and Big Pharma is finding ways to improve their current patents and processes.

One example that I have seen is Talecris' viral inactivated therapeutics of some of thier processes to insure safety of their product and essentially marketability. If Big Pharma can make ways to improve their medication then they can keep making a profit. Look for Talecris' IPO in the near future. Their products are derived from Human Blood Plasma. The various proteins extracted from plasma can be used to treat a variety of diseases including immune deficiencies, genetic emphysema, and hemophilia. This viral inactivation process is key to their marketability and profits. Check out their pipeline at the following link: http://www.talecris.com/talecris-research-development-pipeline.htm

Now its charts charts and more charts. But the charts should help you in your forecasting for your own stocks. I like Roche,Novartis and Pfizer. I also think that Merck will be a huge player in the future with the acquisition of Schering-Plough and Schering's recent acquisition of Organon Biosciences. Schering has added a nice pipeline with their acquisition and now Merck will reap the benefits of this. Do not forget to look at the top 10 R&D chart. It's key to understanding and forecasting. Blockbusters can be made overnight through good R&D.

The Roche-Genentech takeover will be huge as Biologics will become the drugs of the future. Genomic science is key to understanding and creating new drugs and Genentech is king in the Genomic world. The only shocker that could top Roche would be a Merger between Pfizer and Novartis. Or really Novartis and anybody in the top 10. Pigs will fly and OJ will go to jail. Oh wait OJ is already in jail. Lets just wait and see.

NOTE: Click on the Chart If It Is Hard To See.

Here are the top 10 products by sales for 2008

And now here are the top 10 products forecast for 2014

Top Drugs and their estimated expiration date through 2012

Top 15 Companies estimated from 2007 for 2014

Top 10 Oncology Sales from 2007 forecast for 2014

Top 10 Research and Development by Therapeutic Area

Labels:

Bayer AG,

Big Pharma,

Biologics,

Biotechnology,

EvaluatePharma 2014 forecast,

Genentech,

Generic Drugs,

GlaxoSmithKline,

Merck,

Novartis,

Pfizer,

Roche,

Schering-Plough,

Talecris

Subscribe to:

Posts (Atom)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=bdffcf7a-92a5-4b3f-9d68-c89fa2315641)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=324efd9a-c58d-49ab-a57f-e5ec0cb3ec8a)