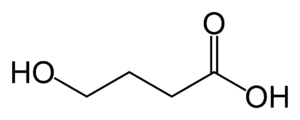

Interest for Raptor Pharmaceuticals is really picking up in 2011. Here are the recent headlines for this up and coming Small Cap Pharmaceutical company. It has a Pipeline for Rare Diseases and I expect 2011 to be a strong year for Raptor Pharmaceuticals if Clinical Trial results are successful. Results for DR Cysteamine clinical trials is expected in 1Q 2011. DR Cysteamine has clinical development programs including:

◦Nephropathic Cystinosis, a rare genetic disorder (Phase 3)

◦Non-alcoholic Steatohepatitis (NASH), a metabolic disorder of the liver (Phase 2)

◦Huntington's Disease, an inherited neurodegenerative disease (Phase 2)

Raptor Pharmaceuticals Stock Quote: RTTP Google Finance

Read more from their previous 10-K filings for the company's Strategic Development Plan here.

Find out more about their Clinical Pipeline here.

Continued

Stock investments ranging from Biotech, Pharmaceutical, and Medical Devices in the Healthcare Sector. Covering Clinical Trial recommendations and FDA Approvals.

Showing posts with label Biotechnology and Pharmaceuticals. Show all posts

Showing posts with label Biotechnology and Pharmaceuticals. Show all posts

1/10/11

10/15/10

TheStreet Equity Top Picks: Biotechnology

Wall Street BiotechnologyTheStreet's Top Rated Stocks

Wall Street BiotechnologyTheStreet's Top Rated Stocks Equity Top: Biotechnology Stocks 10/14/10

Follow Biopharma Investor for more Top Picks: http://feeds.feedburner.com/biopharmainvestor

Wikinvest Symbol--Biotech Company and Corporate Website-- Rating

Labels:

Amgen,

Biogen Idec,

BioPharmaceuticals,

Biotechnology,

Biotechnology and Pharmaceuticals,

Equity Top Picks,

Pharmaceutical,

The Stree,

TheStreet,

Top Biotechnology Stocks,

WikInvest

10/13/10

Sometimes The Best Things In Life Are Free

I just wanted to invite everyone to share in the success of BioPharma Investor's Biotechnology and Pharmaceutical Stock Blog. Follow Biopharma Investor for the most up to date FDA and Clinical Trial news in the industry. Subscribe to my feed at: http://feeds.feedburner.com/biopharmainvestor.

I recently noticed that BioRunUp.com went from a free site to a pay site. Currently BioRunUp.com is charging subscriptions for $299 a year or $99 a month. BioRunUp is a nice website that is affiliated with MikeHavRx.com. A subscription to MikeHavRx.com is $300 a year or $50 a month. Although I too would like to set up my own BioPharma site and have subscriber content, BioPharma Investor Blog will always be free. I respect the other two sites and think their content is a fair value, but why not just follow my blog instead. Hey you can't beat free stuff. You may say you get what you pay for, but I am just as knowledgeable and creditworthy as the other sites. I simply offer my content for free.

Although I cannot give you the exact same advice as the other two sites, I am charging absolutely nothing. I have worked in the industry and have experience in FDA decisions and Clinical Trials. Like Facebook's Mark Zuckerberg, I see the value in the website and want to keep the content easily accessible for everyone. I apply the same BioRunUp principles and I provide up to the minute news on the Biotech and Pharmaceutical Stock Investments. BioPharma Investor recently won an award for Best Biotech Blog and I would ask you to follow me and subscribe to my feeds. Donate a coffee or two to paypal if you have the chance. It's safe and secure.

I apply due dilegence to stock investing and provide news on FDA outcomes and Clinical Trial Data That does not mean I am always right but no one is 100% perfect on their trades. I provide a unique philosophy on investing and I also have learned about shorting stocks on negative FDA outcomes. Although this is risky, I see it as an important play where Clinical Trials are costing biotechs and pharmaceuticals millions of dollars, only to be rejected by the FDA. But most of the time I stick to sound investments and quality clinical trials with the highest level of success.

I will do my best to provide premium content for my readers and will maintain this blog as a free site. Although I am highly successful at making trades I can't make any promises. This is a high risk, high reward market. Anything and everything can happen. I only will provide you with all the information I have on the latest trends in Biotech and Pharmaceuticals. I try to stay away from the dreaded Pump and Dumps and if I see that it is in fact a pump and dump, I will probably be shorting the stock instead of investing in it for the long run.

Thanks for all your support.

BioPharma Investor

Disclosure: Before investing in any stock you should contact your financial advisor. BioPharma investor is for informational purposes only. I am not a securities broker and this website is for informational purposes only. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing.

Related articles

- The 10 Best Values in Pharma and Biotech - Motley Fool (news.google.com)

- Mark Zuckerberg Talks About Facebook's 'Co-Efficient' in the Least-Creepy Way Possible (blogs.forbes.com)

- Perfect BioTiming! (wallstreetpit.com)

- How Mark Zuckerberg's Vision Saved Facebook (thedailybeast.com)

- The Social Network, The Mark Zuckerberg and Facebook Story (arkhilario.com)

Labels:

Best Biotechnology Blog,

BioPharma Blog,

BioRunUp,

Biorunup.com,

Biotech Blog,

Biotechnology and Pharmaceuticals,

Facebook,

Investing,

Mark Zuckerberg,

MikeHavRx.com,

Pharmaceutical Blog

10/12/10

Big Pharma Earnings Preview: US Drug Makers May Report Lower 3Q Profits

Stocks Mentioned in this article:

Johnson and Johnson (JNJ)

Eli Lilly and Co. (LLY)

Merck (MRK)

Pfizer (PFE)

EARNINGS PREVIEW: US Drug Makers May Report Lower 3Q Profit

By Nathan Becker, Of DOW JONES NEWSWIRES

TAKING THE PULSE: Analysts expect most major U.S. drug makers to post third- quarter earnings slightly lower than those a year earlier, as sales of several big-name drugs have declined recently after some consumers cut back on health- care costs. Health-care reform and European national health programs imposing price cuts on drugs also offer added pressure for companies. Results in recent quarters have been skewed by big acquisitions, either boosting companies' revenue or sagging their bottom lines because of charges. Several of the industry bigwigs have also been subject to downbeat credit-ratings news because of recent problems with supply and pipeline issues, as well as upcoming patent expiry.

COMPANIES TO WATCH:

Johnson and Johnson (JNJ)

Eli Lilly and Co. (LLY)

Merck (MRK)

Pfizer (PFE)

EARNINGS PREVIEW: US Drug Makers May Report Lower 3Q Profit

By Nathan Becker, Of DOW JONES NEWSWIRES

TAKING THE PULSE: Analysts expect most major U.S. drug makers to post third- quarter earnings slightly lower than those a year earlier, as sales of several big-name drugs have declined recently after some consumers cut back on health- care costs. Health-care reform and European national health programs imposing price cuts on drugs also offer added pressure for companies. Results in recent quarters have been skewed by big acquisitions, either boosting companies' revenue or sagging their bottom lines because of charges. Several of the industry bigwigs have also been subject to downbeat credit-ratings news because of recent problems with supply and pipeline issues, as well as upcoming patent expiry.

COMPANIES TO WATCH:

Labels:

Biotechnology and Pharmaceuticals,

Earnings,

Earnings Preview 3Q,

Eli Lilly,

Johnson and Johnson,

King Pharmaceuticals,

Merck,

Pfizer

Big Gains For Pain Therapy Stocks Today: KG, PTIE, WPI, ENDP

So Pfizer is increasing their portfolio with King Pharmaceuticals, a maker of veterinary meds and pain therapies. In addition to this news, another company came into the spotlight for pain management therapies. This company is Pain Therapeutics (PTIE). Pain Therapeutics is in clinical trials now in collaboration with King Pharmaceuticals so look for Pfizer to kick in some clinical trial expertise with Pain Therapeutics (PTIE). Additional companies involved in pain therapies is Endo Pharmaceuticals. I highly suggest buying Endo as a buy right now. Since June 2010 Endo's stock has risen form 20.22 to its current trading at 34.99. I suggest a limit order to buy at some discount. Another Pain therapies stock is Watson Pharmaceuticals, a generic drug maker.

My opinion on this is that Pain Therapeutics could be slightly overvalued on the hyped news, and although it may seem attractive to buy right now, I suggest waiting for the pullback as it will be years before these clinical trials are actually approved by the FDA. Also, I am a little cautious placing a buy on Pfizer right now as they will be losing patents on Lipitor next year and other brand name drugs will become available as generics. I might actually place Pfizer's stock right now on hold or sell, as earnings could be lower than expected. Just because everyone is doing it does not make it a buy in my opinion. I actually do not necessarily see King Pharmaceuticals as such a hot buy with only 4.85% profit margin and 18M in profits on 380M in revenue. But given that layoff will presume who knows.

Stick to your guns and remain a cautious investor and good things will come. I apply Warren Buffett's principles to the BioPharma Stock World and like purchasing stocks at a discount. You should be searching for the next Pfizer and not chasing after something that is overly hyped. Just my opinion.

Stocks mentioned in this article

Pfizer--(PFE)

King Pharmaceuticals --(KG)

Endo Pharmaceuticals --(ENDP)

Pain Therapeutics --(PTIE) Up 18.56% today on the news

Watson Pharmaceuticals--(WPI)

Labels:

Alexza Pharmaceuticals,

Biotechnology and Pharmaceuticals,

Endo Pharmaceuticals,

FDA,

Geron,

King Pharmaceuticals,

Pain management,

Pain Therapies,

Pfizer,

TheStreet,

Warren Buffett

10/8/10

Top Biotechnology Blog

I won Top Biotechnology Blog Award this Week. Thanks for the Support.

Top Biotechnology Blogs

If you are interested in biotech ethics, health & life sciences or agriculture, then you might just be interested in learning more about biotechnology. Biotechnology involves microbiology, animal cell structure, biochemistry and more. But where do you start? How do you know what field you are best suited for within the large umbrella called biotechnology? What are the various applications? What of crop yield and environmental stresses to crop yield? And what of genetic testing and cloning? Learn the ethics as well as the procedures; discover what biotechnology involves and the current trends and medical discoveries out there. Educate yourself from the best award winning blogs on the planet. See where you’d like to journey.

So join me in congratulating our Top Biotechnology Blogs presented by Masters Degree Online.

BioPharma Investor

http://biopharmainvestor.blogspot.com/

Thanks Master's Degree Online.

Top Biotechnology Blogs

If you are interested in biotech ethics, health & life sciences or agriculture, then you might just be interested in learning more about biotechnology. Biotechnology involves microbiology, animal cell structure, biochemistry and more. But where do you start? How do you know what field you are best suited for within the large umbrella called biotechnology? What are the various applications? What of crop yield and environmental stresses to crop yield? And what of genetic testing and cloning? Learn the ethics as well as the procedures; discover what biotechnology involves and the current trends and medical discoveries out there. Educate yourself from the best award winning blogs on the planet. See where you’d like to journey.

So join me in congratulating our Top Biotechnology Blogs presented by Masters Degree Online.

BioPharma Investor

http://biopharmainvestor.blogspot.com/

Thanks Master's Degree Online.

Labels:

Biotechnology,

Biotechnology and Pharmaceuticals,

Business,

Masters Degree Online,

Online Masters Degree Programs,

Top Biotechnology Blog

8/27/10

Friday's Top Performing Healthcare Stocks

Image via Wikipedia Here are today's top performing Biotech, Pharmaceutical and Medical Stocks. The stock market did well today but these stocks took off today. Most have been beaten up pretty bad with the economic downturn this past year and lack of credit lending for biotech businesses by the big banks.

Image via Wikipedia Here are today's top performing Biotech, Pharmaceutical and Medical Stocks. The stock market did well today but these stocks took off today. Most have been beaten up pretty bad with the economic downturn this past year and lack of credit lending for biotech businesses by the big banks. Top Performing Medical Stocks

Labels:

Biotechnology,

Biotechnology and Pharmaceuticals,

Investing,

Pharmaceuticals,

Stocks and Bonds,

Top Performing BioPharma Stocks

8/20/10

Jazz Pharma rejected for Fibramyalgia Drug by FDA vote 20-2

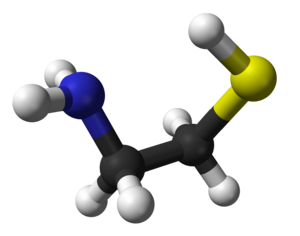

Image via Wikipedia Okay I'm not going to write an article about woulda coulda shoulda. But Jazz was shot down today heavily by the FDA by a vote of 20-No 2 Yes. Mostly due to concerns over abuse of the JZP-6 sodium oxybate drug which is highly similar to GHB. GHB was banned altogether by the FDA in 1990 and is viewed to have no medical benefits in the US.

Image via Wikipedia Okay I'm not going to write an article about woulda coulda shoulda. But Jazz was shot down today heavily by the FDA by a vote of 20-No 2 Yes. Mostly due to concerns over abuse of the JZP-6 sodium oxybate drug which is highly similar to GHB. GHB was banned altogether by the FDA in 1990 and is viewed to have no medical benefits in the US.

Labels:

Biotechnology and Pharmaceuticals,

FDA,

Gamma-Hydroxybutyric acid,

Jazz Pharmaceuticals,

Top Performing BioPharma Stocks,

Xyrem

8/19/10

Thursday's Top Performing Biotech and Pharmaceutical Stocks

Dismal day again on Wall Street as Unemployment Data showed 500,000 new jobless claims and increased fears of a double dip recession are mounting. Also, a fear in tax hikes with the end of Bush Tax cuts ending in 135 days. The economy is very nervous and jittery. Luckily BioPharma plays can go up regardless of all of this negative news. Unfortunately, not as much as they used to because of nervous investors who sell, sell, sell before FDA decisions. I understand though. I wouldn't want to lose a lot of money because of a negative recommendation either. Sometimes you have to go with your gut on some things and let it ride.

Big news with Intel buying McAfee for a premium as McAfee's stock rose 57%. But the BioPharma market painted a different picture with most stocks down for the day between 1-2% overall. Tomorrow is a big day for Jazz Pharma with FDA recommendation panel for their Fibramyalgia medication. I expect approval and a strong day for Jazz. If not then it will go down heavily. But I just don't see that happening as the medication is already approved for Necrolepsy. There is a huge safety concern for the medication as outlined in yesterday's Wall St. Journal article FDA Raises Concerns About Fibromyalgia Drug. This being said I am letting it ride tomorrow and if it goes up it goes up, if it goes down it goes down. We will see.

Investment plays I currently like are BioElectronics BIEL, Amarin AMRN, and Exact Sciences EXAS. Jiangbo Pharmaceuticals JGBO has been gaining strength lately with a Strong Buy rating, Endo Pharmaceuticals ENDO, and KV Pharmaceuticals KVA.

Thursday's Top Performing Pharmaceuticals

Big news with Intel buying McAfee for a premium as McAfee's stock rose 57%. But the BioPharma market painted a different picture with most stocks down for the day between 1-2% overall. Tomorrow is a big day for Jazz Pharma with FDA recommendation panel for their Fibramyalgia medication. I expect approval and a strong day for Jazz. If not then it will go down heavily. But I just don't see that happening as the medication is already approved for Necrolepsy. There is a huge safety concern for the medication as outlined in yesterday's Wall St. Journal article FDA Raises Concerns About Fibromyalgia Drug. This being said I am letting it ride tomorrow and if it goes up it goes up, if it goes down it goes down. We will see.

Investment plays I currently like are BioElectronics BIEL, Amarin AMRN, and Exact Sciences EXAS. Jiangbo Pharmaceuticals JGBO has been gaining strength lately with a Strong Buy rating, Endo Pharmaceuticals ENDO, and KV Pharmaceuticals KVA.

Thursday's Top Performing Pharmaceuticals

8/18/10

Top Performing Biotech and Pharmaceuticals for Wednesday August 18th

Image via CrunchBase Today was a good day for recommendations and Friday gets even better with Jazz Pharmaceuticals presenting August 20th to the FDA for their Fibramyalgia medication JZP-6 sodium oxybate. Jazz had huge gains this morning as the FDA handed out their review of the clinical trial. Jazz shot up around the 11.90 mark and has been so oversold that right now it's pushing 10.49 in afterhours trading. It has been All Over The Map Today. Speaking of all over the map, BSD Medical exploded today with their medical device approval from the FDA. Just exploded all over the map. What a day.

Image via CrunchBase Today was a good day for recommendations and Friday gets even better with Jazz Pharmaceuticals presenting August 20th to the FDA for their Fibramyalgia medication JZP-6 sodium oxybate. Jazz had huge gains this morning as the FDA handed out their review of the clinical trial. Jazz shot up around the 11.90 mark and has been so oversold that right now it's pushing 10.49 in afterhours trading. It has been All Over The Map Today. Speaking of all over the map, BSD Medical exploded today with their medical device approval from the FDA. Just exploded all over the map. What a day. Jazz was disappointing in the fact that everyone sold. Everyone is scared to death to leave it in the market for the FDA decision. Shoot the dice and let it roll sometimes. But we know where most people stand on this one. I'm taking my profits and waiting for tomorrow where I kick myself for selling. This one's a no-brainer in my department for Approval tomorrow.

Top Performing Biotech Stocks for Wednesday August 18th

Labels:

Biotechnology and Pharmaceuticals,

Endo Pharmaceuticals,

FDA,

Jazz Pharmaceuticals,

Top Performing Biotech Pharmaceuticals Stocks

8/17/10

Biotech and Pharmaceuticals Top Performers Tuesday's Edition

Big Day today in the market as Wal-Mart, Kraft and Home Depot pushed earnings up today. Both the DOW and NASDAQ were up 1% today, but this does little to mend the broken market returns of last week just yet.

My big surprise is the Biotech and Pharmaceuticals that don't rise much before big FDA decisions anymore. They seem to crash with the market and get oversold quickly before the big decisions. Jazz Pharma has been down heavily the past two sessions and others as of late have been slightly mixed before big FDA Decisions are looming.

Nonetheless here are today's Top Performers. Beat The Street on these stocks today. I like a lot of these upswing trades made today for Long-Term Growth.

Top Biotech Performers Tuesday

My big surprise is the Biotech and Pharmaceuticals that don't rise much before big FDA decisions anymore. They seem to crash with the market and get oversold quickly before the big decisions. Jazz Pharma has been down heavily the past two sessions and others as of late have been slightly mixed before big FDA Decisions are looming.

Nonetheless here are today's Top Performers. Beat The Street on these stocks today. I like a lot of these upswing trades made today for Long-Term Growth.

Top Biotech Performers Tuesday

8/12/10

Top BioPharma Performers Thursday August 12th

8/11/10

Market Thoughts for Wednesday August 11th

The market took a hammering today but some stocks actually performed or are now great buys. The DOW Industrial average DIJA is closing sharply lower today at 10379. That's a 265 drop from yesterdays close of 10644 and a 2.49% decline as Global Fear strikes domestic and foreign markets.

Today's top performers in BioPharma for August 11th.

Biotech

Today's top performers in BioPharma for August 11th.

Biotech

Labels:

ARNA,

AVNR,

BIOD,

BioPharma Investments,

Biotechnology and Pharmaceuticals,

Biovail,

BVF,

CYPB,

DDSS,

DEPO,

DIJA,

IRSB,

Jazz,

SPEX,

TKPHF,

Valeant Pharmaceuticals

8/8/10

Top BioPharma Pipeline Plays August 2010

Image via CrunchBase Stocks currently on my Watchlist for top BioPharma plays in the near future.

Image via CrunchBase Stocks currently on my Watchlist for top BioPharma plays in the near future.1. Valeant Pharmaceuticals (NYSE:VRX)

Biotechnology Research Report on Valeant's Potiga

On August 11, 2010, we expect the U.S. Food and Drug Administration's (FDA) Peripheral and Central Nervous System Drugs Advisory Committee to review the marketing application of Valeant Pharmaceuticals International’s (VRX) Potiga (formerly known as Retigabine), designed for the treatment of partial-onset seizures in epilepsy patients who have become refractory (failing to show response to prior therapy) to anti-epilepsy drugs (AEDs).

Labels:

Arena Pharmaceuticals,

ARNA,

Biotechnology and Pharmaceuticals,

CELG,

Celgene,

Elan Corporation,

ELN,

Jazz,

Jazz Pharmaceuticals,

Merck,

MRK,

Valeant Pharmaceutical,

VRX

10/1/09

October Biotech Calendar: Key Dates and Events

Biotech Calendar: Key Dates and EventsA quick and dirty guide to important biotech events for October.

By Adam Feuerstein, TheStreet.com Senior Columnist

THESTREET.COM — 09/30/09

BOSTON (TheStreet) -- A calendar of important, potentially stock-moving biotech events for October:

Oct. 5-6

JMP Securities Healthcare Focus conference

Oct. 7-8

Cowen & Co. 12 th Annual Therapeutics Conference

Oct. 8

FDA approval decision date for Spectrum Pharmaceuticals' (Symbol: SPPI) colon cancer drug Fusilev.

By Adam Feuerstein, TheStreet.com Senior Columnist

THESTREET.COM — 09/30/09

BOSTON (TheStreet) -- A calendar of important, potentially stock-moving biotech events for October:

Oct. 5-6

JMP Securities Healthcare Focus conference

Oct. 7-8

Cowen & Co. 12 th Annual Therapeutics Conference

Oct. 8

FDA approval decision date for Spectrum Pharmaceuticals' (Symbol: SPPI) colon cancer drug Fusilev.

Labels:

Arena Pharmaceuticals,

Biotechnology and Pharmaceuticals,

Clinical trial,

Cubist Pharmaceuticals,

FDA Calendar,

Spectrum Pharmaceuticals

9/22/09

Cytokinetics Shows Favorable Phase II results

Cytokinetics (CYTK) is a clinical trial drugmaker that has been making some ground-breaking news this past week. They have numerous clinical trials taking place right now ranging from oncology (breast cancer and non-Hodgkin's lymphoma) to high risk heart failure. Their stock has risen in the past week from 3.50 to a high of 5.00 Monday afternoon 092209. Today the stock is trading at 4.67. Currently, they are recruiting patients for 3 Clinical Trials for their pipeline medications. Here is their ClinicalTrials.gov link: Cytokinetics Trials

Cytokinetics recently announced favorable Phase II data from last week for its Heart Failure medication. Here is the presss release from their website.

Cytokinetics Presents Phase IIa Clinical Trials Data on Omecamtiv Mecarbil at the 2009 Heart Failure Society of America Annual Meeting

Labels:

Amgen,

Biotechnology and Pharmaceuticals,

Breast cancer,

CYTK,

Cytokinetics,

GlaxoSmithKline,

High Risk Heart Failure,

Oncology

7/7/09

World Pharma News Bayer files patent infringement against Teva Pharma

Okay sorry but I missed this article but this one is a large lawsuit against a large generic maker Teva Pharma. Lengthy court battle will likely be insued and a huge settlement for Bayer could mean a large fine for Teva. Bayer is the maker of Levitra which has been another ED drug like Viagra, or other ed pills out there. Bayer used to have the Levitra ad with the NFL a couple of years ago. So Im sure this will be a billion dollar lawsuit that could help or hurt the bottom line of either of the two companies.

Bayer files patent infringement lawsuit against Teva Pharmaceuticals

Thursday, 02 July 2009

Bayer Schering Pharma AG, Germany and Bayer HealthCare Pharmaceuticals Inc. together with Schering Corporation have filed a patent infringement lawsuit in the U.S. Federal Court in the District of Delaware against Teva Pharmaceuticals USA, Inc. and Teva Pharmaceutical Industries, Ltd. The lawsuit concerns Teva's application to the FDA for approval to market a generic form of Levitra®, Bayer Schering Pharma's therapy for the treatment of erectile dysfunction, prior to patent expiration. The patent at issue in the suit is Bayer Schering Pharma's U.S. Patent No. 6,362,178, expiring in 2018. In the US, Levitra® is marketed by Schering-Plough and GlaxoSmithKline.

About Bayer HealthCare

The Bayer Group is a global enterprise with core competencies in the fields of health care, nutrition and high-tech materials. Bayer HealthCare, a subsidiary of Bayer AG, is one of the world’s leading, innovative companies in the healthcare and medical products industry and is based in Leverkusen, Germany. The company combines the global activities of the Animal Health, Bayer Schering Pharma, Consumer Care and Medical Care divisions. Bayer HealthCare's aim is to discover and manufacture products that will improve human and animal health worldwide. Find more information at http://www.bayerhealthcare.com.

Bayer Schering Pharma is a worldwide leading specialty pharmaceutical company. Its research and business activities are focused on the following areas: Diagnostic Imaging, General Medicine, Specialty Medicine and Women's Healthcare. With innovative products, Bayer Schering Pharma aims for leading positions in specialized markets worldwide. Using new ideas, Bayer Schering Pharma aims to make a contribution to medical progress and strives to improve the quality of life. Find more information at http://www.bayerscheringpharma.de.

Oh and on a side note I have included my bayer aspirin heroin ad from 1901. I used to think about the Nazi's when I worked there but thats another story. Get to Work. Work Faster. You must work it. Work it like a German. said with a heavy german accent

Labels:

Bayer AG,

Biotechnology and Pharmaceuticals,

Schering-Plough,

Teva Pharmaceutical Industries

Jazz Pharmaceutical pays back loans and interest owed. Stock up big for today. JAZZ

Jazz Pharmaceuticals Pays Accrued Interest Under Senior Secured Notes

PALO ALTO, Calif., July 7, 2009 /PRNewswire-FirstCall/ -- Jazz Pharmaceuticals, Inc. (Nasdaq: JAZZ) today announced that it has paid to the holders of its senior secured notes the interest payments that were due, but not paid, on December 31, 2008, March 31, 2009 and June 30, 2009, for a total payment of approximately $14.6 million. The $119.5 million principal amount of the notes is due in June 2011. Jazz Pharmaceuticals also announced today that it has delivered to the holders of the notes financial statements for the quarter ended June 30, 2009, which indicate that Jazz Pharmaceuticals had achieved as of June 30, 2009 net product sales at the level required to suspend its prior obligation to maintain a minimum cash balance in an account that is pledged to the collateral agent for the notes. The requirement to maintain the account was triggered in May 2009, and Jazz Pharmaceuticals did not, at that time, establish the required account.

Jazz Pharmaceuticals believes that it has cured all material defaults under the agreement governing the notes, and that it will be able to comply with the agreement on an ongoing basis, including payment of future interest payments when due and repayment of the principal amount of the notes when due in June 2011.

About Jazz Pharmaceuticals, Inc.

Jazz Pharmaceuticals is a specialty pharmaceutical company that identifies, develops and commercializes innovative treatments for important, underserved markets in neurology and psychiatry. For further information, please see www.jazzpharmaceuticals.com.

The co also announced the signing and closing of a private placement of an aggregate of 1,895,734 units, comprised of an aggregate of 1,895,734 shares of common stock and warrants to purchase up to 947,867 additional shares of common stock for aggregate gross proceeds of approx $7 mln. The per unit purchase price for a share of common stock and a warrant to purchase 0.50 of a share of common stock was $3.6925. The warrants have an exercise price of $4.00 per share and are exercisable for seven years.

Jazz Quote FROM NASDAQ:

7/7/2009 12:56:39 PM Market Open

NASDAQ Last Sale

4.3001 0.67 18.46% UP

Volume

3,141,201

Previous Close

$ 3.63

Today's High

$ 4.98

Today's Low

$ 3.61

52 Wk High

$ 8.85 52 Wk Low

$ .515

NASDAQ Official Price

Open Price/Date

$ 3.86

Jul 07, 2009 Close Price/Date

$ 3.63

Jul 06, 2009

1y Target Est

$ 4.50

Labels:

Biotechnology and Pharmaceuticals,

Business,

Jazz,

Jazz Pharmaceuticals,

Pharmaceutical industry,

Pharmaceuticals,

Stock

Subscribe to:

Posts (Atom)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=bb943f1f-ff3b-40f2-9455-04a6e3ce8237)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=4dfebace-28c9-4210-8139-ba860abc7ed7)