Image via WikipediaLessons learned

Image via WikipediaLessons learnedCommentary: On this day 23 years ago, the stock market crashed

By MarketWatch

CHAPEL HILL, N.C. (MarketWatch) — Today is a somber anniversary for anyone who is at least 45 years old.

And while anyone younger than that probably doesn’t remember what happened on Oct. 19, 1987, since they were not yet out of college, they should also study what happened on what came to be known as Black Monday. This includes most mutual fund managers, by the way.

If you would like more Subscribe To BioPharma Investor for everyday stock news and up to date FDA decisions. Biopharma Investor

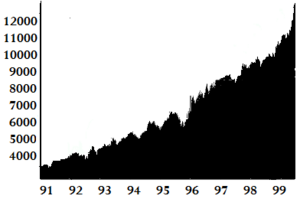

The Dow Jones Industrial Average (DJIA 11,017, -126.92, -1.14%) dropped 508 points on this day 23 years ago, which at first blush might not seem all that noteworthy. After all, the Dow dropped nearly a thousand points in just a few minutes on the occasion of the infamous Flash Crash this past May.

But the Dow was a lot lower in 1987, which meant that the 508-point drop was far bigger in percentage terms — 22.6%, in fact. If a similarly sized plunge were to occur at today’s relatively lofty levels, the Dow would drop nearly 2,500 points.

Bank of America's loss widens Paul Vigna discusses a slew of earnings, beginning with Bank of America's losses and Goldman Sachs's gains.

Such an extraordinary plunge may strike you as most unlikely, and you’d be right. But we’re kidding ourselves if we think that another drop of that magnitude won’t happen again.

In fact, according to a fascinating body of research (championed in large part by Xavier Gabaix, a finance professor at New York University) plunges as big as 1987’s Black Monday — while rare — are an inherent part of the investment landscape.

Gabaix discovered that the frequency with which huge plunges occur follows a well-known tendency known as Zipf’s Law. A crash like 1987’s, for example, will occur once every 75 years or so, on average.

Because this is an average frequency over many years, Zipf’s Law doesn’t tell us when the next crash will occur.

But it does mean that we need to arrange our financial affairs on the assurance that another one, some day, will take place.

Image via Wikipedia

Image via WikipediaU.S. stocks tumble after China rate hike

By Kate Gibson, MarketWatchNEW YORK

U.S. stocks fell sharply Tuesday after Apple Inc. sold fewer-than-hoped iPads, Bank of America Corp. reported a surprise loss and China hiked a key interest rate to curb rising inflation.

“The Chinese raising those rates a bit — I wouldn’t say it spooked the market, but China is the globe’s engine of growth,” said Jay Suskind, senior vice president at Duncan-Williams Inc.

After sliding below 11,000 for the first time in a week, the Dow Jones Industrial Average (DJIA 11,024, -119.20, -1.07%) was lately down 102.48 points, or 0.9%, to 11,041.21, with 23 of its 30 components on the decline.

The S&P 500 Index (SPX 1,172, -12.34, -1.04%) declined 9.5 points, or 0.8%, to 1,175.22, with energy and materials weighing the most among its 10 industry groups and the financial sector faring the best.

The Nasdaq Composite (COMP 2,451, -30.10, -1.21%) shed 23.45 points, or 1%, to 2,457.23.

For every share rising about two fell on the New York Stock Exchange, where 508 million shares had traded as of 1 p.m. Eastern.

Both Apple (AAPL 310.42, -7.58, -2.38%) and IBM Corp. (IBM 138.26, -4.57, -3.20%) reported third-quarter results late Monday, with each beating earnings forecasts, but investors found something to pan in both reports.

Shares of Apple, which reached an all-time high on Monday, were off 2.1%.

Shares of IBM, which said it signed less service deals than anticipated in the third quarter, fell 3.2% even as the Dow component reported robust profits and hiked its 2010 outlook.

On Tuesday, Bank of America (BAC 12.28, -0.06, -0.50%) said its unexpected quarterly loss stemmed from a one-time hit related to credit-card reform legislation passed earlier in the year. Read more about Bank of America’s results.

Goldman Sachs Group Inc. (GS 158.70, +5.00, +3.25%) also reported Tuesday and topped earnings expectations. Read more about Goldman’s results.

But China’s rate-hike announcement drew a negative response on Wall Street, which has not welcomed any move by China seen as trying to curb its economic growth.

The major indexes advanced Monday, with the Dow industrials ending at their highest level since May 3, a level that Suskind said inspired some profit-taking Tuesday.

“We closed yesterday at the highest since early May, so we’re at the upper end of the range now, or some would say we’re at the bottom end of a new range,” said Suskind.

Wall Street offered a muted reaction to economic data, which had the Labor Department estimating that home construction rose 0.3% in September.

“The housing number wasn’t a surprise to the downside, which I guess was a positive. It was the Chinese rate hike with the dollar that affected the downside,” said Suskind of the U.S. currency gaining strength.

Kate Gibson is a reporter for MarketWatch, based in New York.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.